Works with YOUR financial model in EXCEL

Save time by accurately extracting T12, Rent Roll, and OM data into your underwriting model with one click.

Works with your preferred Excel model so you can skip copy/paste and just start underwriting your multi-family real estate deal.

Professional

For multi-family real estate underwriters. Investors, Brokers, Lenders, Accounting Firms. PC only, Mac coming soon.

- Auto-Extract Rent Roll

- Auto-categorize T12 line items

- Extract any section of OM into Excel

- Fast, Accurate, Secure

- Upload Excel, CSV, PDF docs

- Works with your financial model

- Works with MFA financial model

- Easy to use

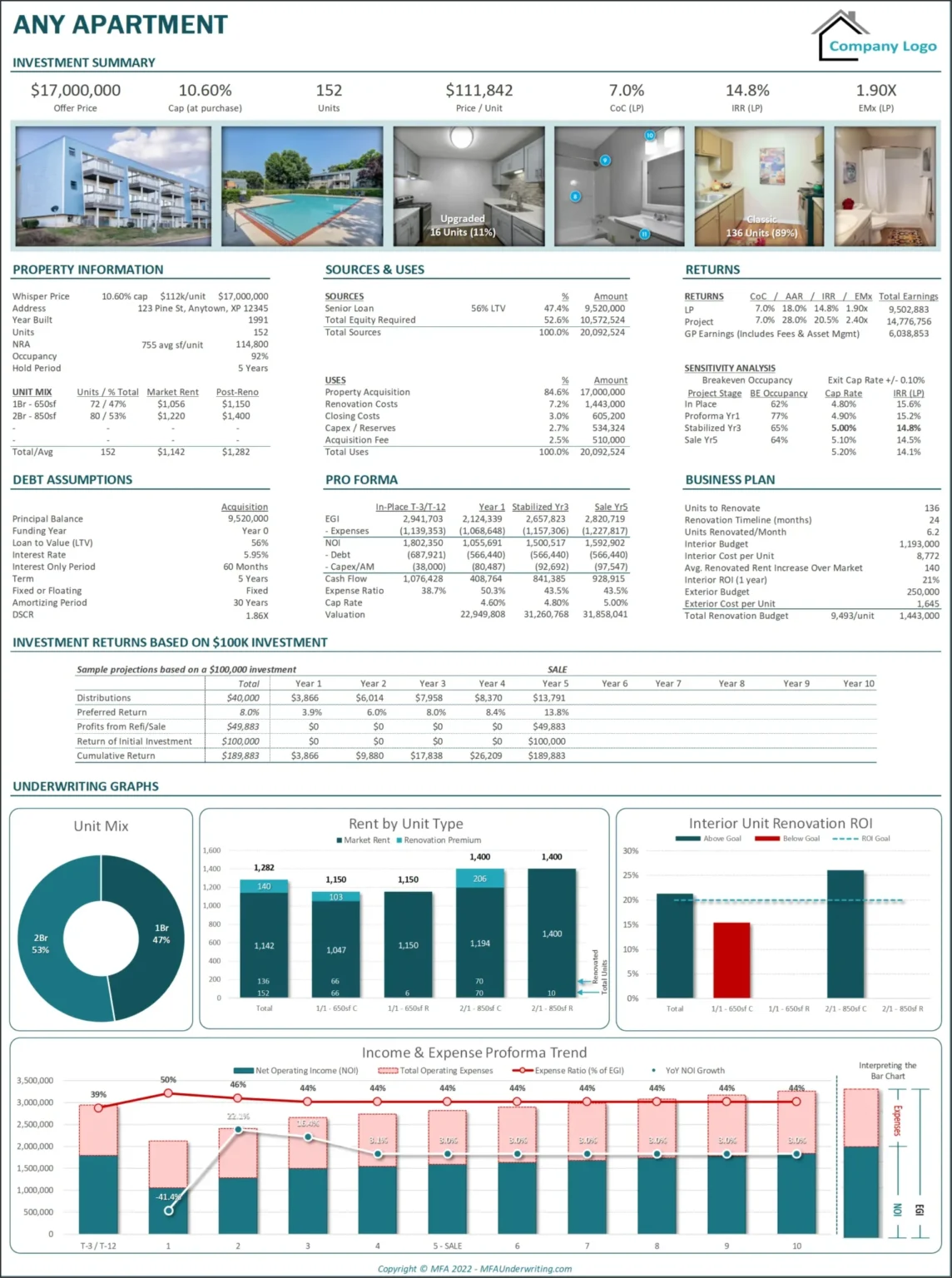

Professional Multi-Family Underwriting

Supercharge your multifamily deal analysis with the MFA underwriting model for Excel.

MFA Advanced Excel Model

Everything you need to analyze multifamily real estate acquisitions like a pro. Includes all future updates, exclusive webinar access, "pro tips" videos, and more. Compatible with QuickData's automated Rent Roll and T12 extraction (subscription required).

- Value-Add Multifamily

- Toolbox

- Graphical Output

- Flexible Underwriting

- Auto Input Rent Roll*

- Unit Mix Summary

- Auto Categorize T12*

- T12 Rev & Expense Summary

- Online Webinars & Community